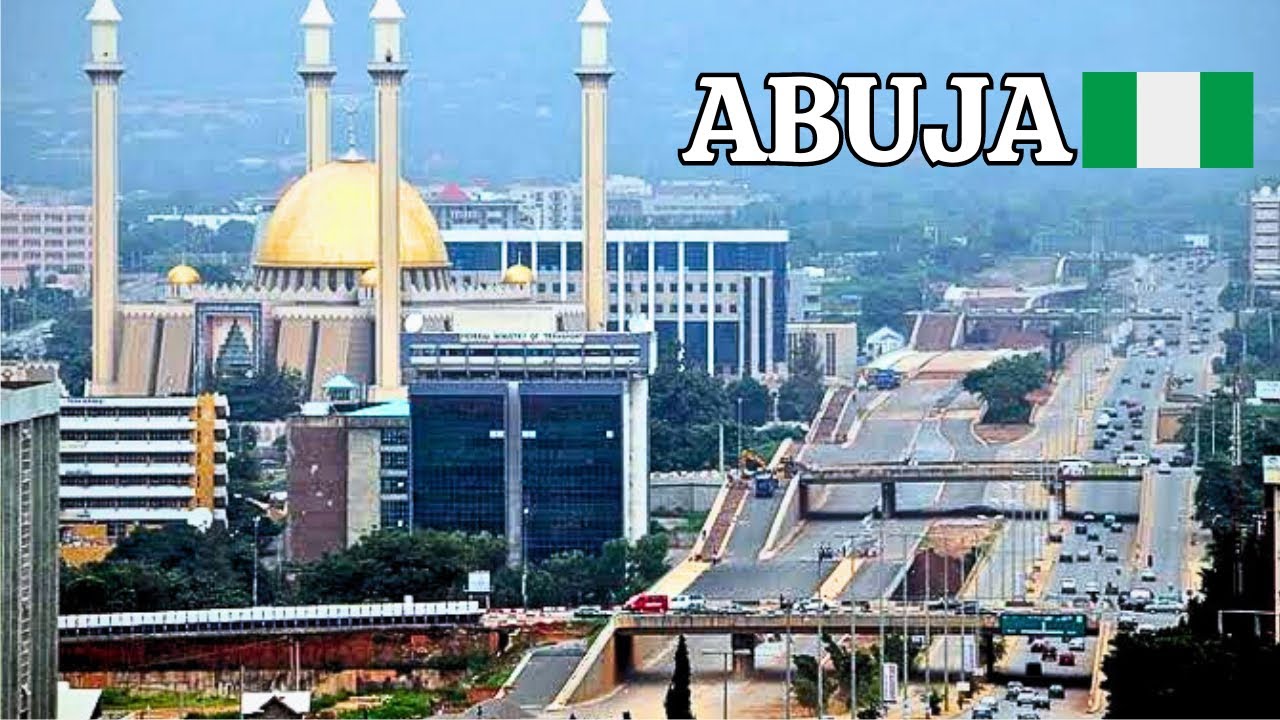

Abuja, the capital city of Nigeria, is more than just politics and government offices. It’s a city of ambition, luxury, and growing opportunities. Many people—young professionals, families, and investors—dream of owning a house here. But the big question remains: how much does it cost to own a house in Nigeria, Abuja precisely?

The answer isn’t so straightforward. It depends on factors like location, size, finishing, and even market trends. Let’s break it down in a way that helps you decide whether Abuja is the right place for your next home investment.

Why Abuja is a Hotspot for Home Ownership

Abuja isn’t just the seat of power; it’s also one of Nigeria’s fastest-growing real estate markets. Here’s why:

-

Prime Infrastructure – Good road networks, proximity to the airport, and well-planned estates.

-

Security & Orderliness – Compared to many cities, Abuja is relatively more organized.

-

Status Symbol – Owning a home in Abuja is often seen as a mark of success.

-

High Investment Value – Property prices appreciate steadily.

This explains why both Nigerians at home and in the diaspora keep asking: “How much does it cost to own a house in Abuja?”

Average Cost of Owning a House in Abuja

So, let’s get to numbers. Depending on the type of property and its location, prices vary widely.

1. Luxury Areas (High-End Properties)

-

Asokoro, Maitama, Wuse 2, Guzape, Karsana – These are Abuja’s “Beverly Hills.” Houses here range from ₦500 million to ₦2 billion, depending on size and finishing. Think mansions, duplexes, and villas.

-

Target Buyers: Politicians, top executives, diplomats.

2. Mid-Range Areas

-

Gwarinpa, Jabi, Apo – Popular among upper-middle-class families and professionals. Prices range from ₦70 million to ₦300 million for duplexes and ₦25 million to ₦60 million for apartments.

-

Target Buyers: Business owners, professionals, upwardly mobile families.

3. Affordable/Developing Areas

-

Lugbe, Kubwa, Kuje, Karu – Perfect for first-time buyers. Houses here cost between ₦10 million and ₦30 million for 2–3 bedroom flats or bungalows.

-

Target Buyers: Middle-income earners, first-time homeowners.

Factors That Influence House Prices in Abuja

1. Location, Location, Location

In Abuja, location is everything. A three-bedroom flat in Maitama might cost the same as a whole duplex in Lugbe.

2. Size and Type of House

-

Duplexes and detached houses are pricier than flats or terrace houses.

-

Luxury mansions with swimming pools and smart home technology cost a fortune.

3. Finishing Quality

Imported marble floors, German kitchens, and Italian fittings can add tens of millions to the price.

4. Land Ownership System

Abuja is under the Federal Capital Territory Administration (FCTA). Most lands are leasehold, not freehold. Buying land legally (with a Certificate of Occupancy) affects house costs.

Real-Life Example: A Young Professional’s Story

Chinedu, a 35-year-old tech consultant, always dreamed of living in Abuja. He started with a two-bedroom flat in Lugbe for ₦15 million in 2018. Fast forward to 2025, the same property is worth almost ₦28 million. Today, he’s saving up for a duplex in Gwarinpa.

This shows how strategic buying, even in less expensive areas, can pay off over time.

Cost Breakdown: Buying vs Building in Abuja

Buying a House

-

Ready-made luxury duplex in Asokoro: ₦800 million – ₦2.5 billion

-

3-bedroom flat in Jabi: ₦30 million – ₦50 million

-

2-bedroom bungalow in Kubwa: ₦12 million – ₦20 million

Building Your Own House

-

Land in Lugbe: ₦5 million – ₦10 million (per 600sqm)

-

Construction cost: ₦15 million – ₦40 million (depending on finishing)

-

Total: ₦20 million – ₦50 million for a modest 3–4 bedroom house.

Building gives you control over design and finishing, while buying saves time.

Tips for Buying a House in Abuja

-

Work with Trusted Realtors – Abuja is full of scams. Verify every document.

-

Check C of O (Certificate of Occupancy) – Ensure land ownership is legal.

-

Visit Multiple Locations – Don’t just focus on Maitama. Affordable areas may offer better long-term value.

-

Factor in Extra Costs – Agency fees, legal fees, and FCTA charges.

-

Plan for Security & Utilities – Some estates offer 24/7 security, water, and power backups, which may increase costs but bring peace of mind.

So, How Much Does It Cost to Own a House in Abuja?

The cost of owning a house in Nigeria, Abuja precisely, ranges from ₦10 million in developing areas to over ₦2 billion in luxury districts. It all depends on your budget, taste, and long-term goals.

If you’re serious about owning a home in Abuja, start by defining your budget, researching locations, and working with trusted agents. The earlier you buy, the more value you lock in for the future.

Fontainebleau Partners Limited is a niche real estate development company, based in Abuja with key focus on the mid to upscale segment of the market. At Fontainebleau, we prioritize class, luxury, comfort, and most importantly, affordability.

Ready to take the next step? Explore our available properties - your dream home might be waiting for you.

Or for beter enquiry you can reach out us via our contact page.

(0) Comments